Zara Target Market Analysis

Understanding a company’s target market is crucial for building relevant products, tailoring marketing strategies, and maintaining a competitive edge. It allows brands to forge strong connections with the right consumers by addressing their specific needs and desires. In the fast-paced world of fashion, where trends change quickly, knowing the customer is more than a business tactic—it’s survival.

Zara, a global fashion powerhouse under the Inditext Group, exemplifies how deep market understanding fuels growth. Known for its stylish yet affordable clothing, Zara has redefined the concept of fast fashion by rapidly delivering new collections inspired by runway styles, streetwear, and customer feedback. Its stores and online platforms serve millions globally, reflecting a customer-first approach grounded in data, agility, and design thinking.

This article explores the Zara target market, unpacking the company’s strategy for identifying and engaging with its audience. We’ll delve into Zara’s key customer demographics, examine its market segmentation tactics, and compare its audience with major competitors like H&M and Uniqlo. Along the way, we’ll look at how Zara localizes campaigns, reacts to behavior trends, and taps into the psychology of fashion. By the end, you’ll gain a complete picture of how Zara aligns its brand with the people who wear it.

Contents

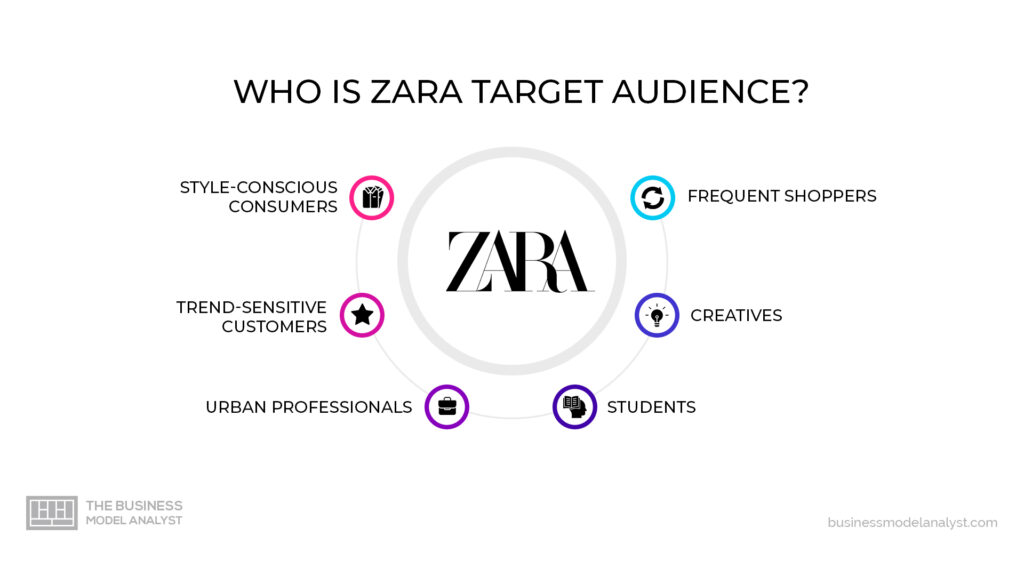

Who is Zara’s Target Audience?

The Zara target market is primarily composed of fashion-conscious, urban individuals aged between 18 and 35. These customers are typically trend-savvy, style-aware, and value quality apparel at reasonable prices. Zara appeals to both men and women, though women’s fashion represents a significant portion of its sales. The brand’s clean, modern aesthetic resonates with those who prefer minimalist yet chic attire.

Zara customers are generally middle- to upper-middle-income earners. While not necessarily wealthy, they are willing to spend on clothing that feels premium without being overpriced. This segment includes young professionals, university students, and early-career creatives who are drawn to Zara’s fast turnaround on fashion trends and its global store presence. They live predominantly in urban or cosmopolitan areas, where trends tend to shift rapidly and brand visibility is key.

Lifestyle plays a crucial role. Zara’s customers often lead busy, socially active lives where appearance matters—whether for work, social media, or nightlife. These shoppers value efficiency, variety, and style, which Zara delivers through frequent product updates and convenient shopping experiences, both in-store and online.

Values also matter. Increasingly, Zara’s younger customers are concerned about sustainability and ethical sourcing. In response, Zara has launched initiatives like its Join Life collection and recycling programs. While not the primary decision-maker for all buyers, sustainability is an emerging factor influencing purchasing behavior, especially among Gen Z.

Zara Target Market Segmentation and Marketing

Market segmentation is the practice of dividing a broad customer base into distinct groups based on shared characteristics such as demographics, location, behavior, or lifestyle. This strategy allows companies to tailor marketing efforts, product offerings, and brand messaging to meet specific customer needs more effectively.

Zara applies a highly dynamic segmentation strategy, allowing it to stay agile in the ever-changing fashion industry. Unlike brands that create seasonal collections months in advance, Zara collects real-time customer feedback and sales data, rapidly adjusting its designs and inventory. This responsiveness helps the brand stay closely aligned with the preferences of its core market segments.

To better understand how Zara reaches its diverse customer base, we can examine the company’s approach through four main segmentation types: demographic, geographic, behavioral, and psychographic. Each of these plays a vital role in helping Zara shape marketing campaigns, choose product lines, and adapt its tone of voice to resonate with specific audiences.

In the following sections, we’ll explore how Zara utilizes each type of segmentation to maintain its market dominance.

Demographic Segmentation

Demographic segmentation focuses on factors such as age, gender, income, and education. Zara leverages this form of segmentation to create fashion-forward collections tailored to a specific yet diverse customer base. The Zara target market primarily includes young adults aged 18 to 35, but the brand also serves teenagers and professionals up to their mid-40s with specific lines and designs.

Women remain Zara’s largest customer group. While the brand offers menswear and kids’ lines, over 60% of its global sales come from its women’s collection. Zara’s marketing and product design reflect this focus—offering stylish silhouettes, on-trend cuts, and seasonal pieces that appeal to both students and working women. For men, Zara targets young professionals and style-conscious consumers looking for modern, versatile wardrobe staples.

Income plays a significant role in Zara’s demographic segmentation. While positioned as an affordable luxury brand, Zara appeals most to middle- and upper-middle-income groups. These consumers can afford to shop regularly and value clothing that mimics high-fashion looks at a fraction of designer prices. This segment includes college students, early-career professionals, and urban creatives who prioritize image and brand perception.

Education and occupation indirectly influence Zara’s appeal. Consumers in media, design, marketing, and tech sectors often gravitate toward Zara’s sleek, contemporary designs. They appreciate its global image and alignment with creative urban lifestyles. Zara’s minimalist advertising strategy—focusing more on brand experience than aggressive promotion—also appeals to educated shoppers who value subtlety over hype.

Geographic Segmentation

Geographic segmentation divides customers by location—countries, regions, cities, or climate zones. Zara uses this segmentation to adapt its offerings to different markets, a crucial factor in its success across more than 200 global markets. From flagship stores in fashion capitals like Paris and New York to locations in emerging cities, Zara fine-tunes its operations based on local preferences.

Zara’s strongest presence is in Europe, especially in Spain, where the company was founded. It also performs exceptionally well in the United States, China, and Latin America. While the fashion tastes of shoppers in Madrid differ from those in Tokyo, Zara maintains a flexible model: centralized production with localized merchandising. For example, warmer climate stores in the Middle East or Southeast Asia often receive lighter fabrics and summer styles for longer durations.

Zara also modifies its store layouts, window displays, and in some cases, pricing based on location. A shopper in Milan might see a more fashion-forward display than one in a smaller city. In India, Zara entered the market through a joint venture with Tata Group to better understand cultural and retail nuances. In China, it embraced popular local platforms like WeChat for customer engagement and e-commerce.

Even online, Zara uses geographic data to localize its digital storefronts, offering different product selections, language options, and promotions. This strategy not only respects regional tastes but also ensures that Zara remains relevant and desirable in diverse cultural settings.

Behavioral Segmentation

Behavioral segmentation looks at how customers act—what they buy, how often, and why. Zara excels at using this segmentation to fine-tune everything from product development to in-store displays. The brand observes patterns like purchase frequency, timing, and product preferences to continually evolve its offerings and improve customer retention.

One of Zara’s most effective tactics is analyzing real-time purchasing behavior. Store managers collect feedback on what sells, what customers ask for, and what gets tried on but not bought. This information is shared with Zara’s design and logistics teams, allowing them to adjust future shipments or rapidly design new versions of in-demand items—often within just two to three weeks.

Zara also recognizes different shopping personas. For example, some customers shop frequently and buy in smaller quantities—these are often fashion-forward individuals who visit weekly to catch new arrivals. Others are seasonal shoppers, stocking up during sales or at the start of fashion seasons. Zara accommodates both through constant inventory refreshes and twice-yearly major sales events, which create urgency and clear space for new trends.

The brand uses behavioral cues to power its loyalty and personalization strategies. While Zara doesn’t rely on traditional loyalty programs like points, its app and website track browsing behavior to suggest relevant products and sizes. Cart reminders and restock notifications are personalized, nudging shoppers toward repeat purchases without being overly promotional.

Ultimately, Zara’s responsiveness to how people shop—when, how much, and why—keeps its audience engaged and coming back for more.

Psychographic Segmentation

Psychographic segmentation delves into customers’ values, lifestyles, attitudes, and personality traits—and this is where Zara truly differentiates itself. The Zara target market consists of people who view fashion as a form of self-expression. These shoppers aren’t just looking for clothes; they’re curating an identity, often guided by confidence, modernity, and subtle sophistication.

Zara appeals to individuals who value individual style over brand flashiness. Unlike other retailers that prominently display logos or celebrity partnerships, Zara takes a minimalist approach to branding. Its marketing is nearly invisible, with no commercials or influencer campaigns. Instead, it relies on the psychological draw of exclusivity—shoppers know that a style available today may be gone next week. This scarcity appeals to customers who pride themselves on discovering pieces before others.

The brand resonates strongly with those who live fast-paced, urban lifestyles. Zara shoppers are often young professionals, creatives, or trendsetters who want stylish looks that keep up with their dynamic routines. Convenience and speed—core values in their daily lives—are matched by Zara’s rapid design cycle and easy shopping experience.

Zara’s newer sustainability messaging speaks to evolving psychographic traits, especially among Gen Z and millennials. These groups seek alignment between their purchases and their personal ethics. The Join Life collection, for example, appeals to shoppers who prioritize eco-consciousness without sacrificing style or affordability.

By understanding its audience’s desire for style, novelty, and alignment with personal values, Zara crafts a brand that feels aspirational yet attainable—chic without shouting.

Zara Marketing Strategy

Zara’s marketing strategy is unique in the fashion world. Unlike many brands that rely on heavy advertising, Zara invests very little in traditional media. Instead, it focuses on store experience, product design, and prime location to naturally draw attention. Its clean, modern storefronts act as marketing billboards, often placed on high-traffic shopping streets around the globe.

Zara uses social media channels like Instagram and Facebook selectively, prioritizing visuals over promotions. Posts are minimalistic but high-impact, emphasizing mood, aesthetic, and seasonal inspiration. Rather than flooding followers with ads, Zara lets the products—and the speed at which they change—do the talking. This reinforces a sense of exclusivity and urgency.

The brand’s core message relies on emotional appeal tied to style, confidence, and immediacy. Zara’s customers feel like insiders to fast-evolving trends. By launching new styles multiple times a week, the brand encourages frequent visits and fuels impulse buying. It’s a strategy that transforms shopping into a habit rather than a planned task.

Zara also adapts its message subtly across markets. In regions where sustainability is a major concern, the company amplifies its eco-friendly initiatives. In trend-sensitive urban centers, it focuses on premium styling and modern silhouettes. Across all markets, Zara’s understated voice and elegant tone remain consistent, reinforcing the brand’s sleek and worldly image.

How Zara Reaches Its Audience

Zara reaches its audience through a seamless mix of digital and physical channels, tailored to varied segments and shopping behaviors.

In-Store Experience

A key method Zara uses is its in-store environment. Stores are typically located in high-traffic, fashionable shopping districts. The layout is minimalist and clean, designed to spotlight current collections. Seasonal changes are frequent, keeping customers coming back to see what’s new. This immersive experience reinforces Zara’s positioning as a trend-driven brand.

Digital and Mobile Engagement

Zara’s mobile app and digital store are critical engagement tools. Customers receive personalized browsing suggestions based on past behavior. Push notifications alert users to restocks or new drops, driving repeat visits. The app combines lookbooks and in-app checkout, making fashion discovery and purchase frictionless.

Social Media and Content Marketing

Zara uses social media platforms like Instagram and Facebook in a curated, visual-first style. The brand avoids overt advertising, instead showcasing stylized photography and mood boards that convey seasonal energy. The ever-changing feed creates a sense of immediacy that mirrors Zara’s fast turnover in product lines.

Localized Campaigns and Events

Zara also deploys localized marketing campaigns in key markets. In China, for instance, it collaborates with influencers and local platforms like WeChat for targeted engagement. Flagship store openings in cities like Shanghai or São Paulo are marked by tailored events, footfall boosters, and media visibility matched to regional fashion sensibilities.

Email and CRM Systems

Zara’s CRM system drives email and direct communication strategies. Instead of generic promotions, newsletters are segmented by region, purchase history, and product interests. This personalization ensures that communications remain relevant without overwhelming the customer.

By weaving together an elegant brick‑and‑mortar environment, tech-forward digital tools, and carefully tuned local campaigns, Zara maintains frequent and meaningful touchpoints with its diverse audience.

Comparison to Competitors’ Target Audience

Zara competes in the fast fashion sector alongside brands like H&M and Uniqlo, each targeting distinct yet overlapping customer groups. While all three focus on affordability and trend accessibility, their audience motivations, brand values, and style priorities differ meaningfully. In this section, we compare the Zara target market to that of its major competitors to reveal strategic positioning advantages and limitations.

Zara vs H&M Target Audience

Zara and H&M both cater to fashion-forward individuals aged 18 to 35. However, H&M casts a wider net demographically, offering ultra-low pricing and promotional campaigns to appeal to budget-conscious consumers, including teens and families. Zara, on the other hand, positions itself as more premium and minimalist, attracting a slightly older, more urban crowd with higher disposable income.

In terms of psychographics, H&M emphasizes sustainability and inclusivity in its branding, with frequent campaigns highlighting diversity and green collections. Zara, while also improving its sustainability image, leads with style sophistication and exclusivity. Its rapid trend cycle and clean brand aesthetic cater to consumers who value self-expression and trend immediacy over affordability alone.

H&M leans heavily on collaborations with celebrities and designers (e.g., Balmain, Mugler), broadening appeal to younger shoppers. Zara avoids celebrity marketing, appealing instead to those who prefer understated style and independence from mainstream branding.

Zara vs Uniqlo Target Audience (optional)

While Zara focuses on style, Uniqlo emphasizes function and comfort. Uniqlo’s target audience includes both young adults and older customers who value timeless basics, performance fabrics, and minimalist design. The brand attracts a more practical, tech-savvy, and quality-oriented consumer base.

Unlike Zara’s trend-driven and high-turnover strategy, Uniqlo offers year-round staples with subtle seasonal shifts. This approach resonates with shoppers who prioritize durability and simplicity over trend rotation. While Zara captures the Instagram-savvy fashion consumer, Uniqlo appeals to efficiency-minded, comfort-focused shoppers—often in tech or academic fields.

Geographically, Uniqlo has stronger roots in Asia and adapts its products well to regional climates and cultural norms. Zara, while global, leads in Europe and Latin America and emphasizes visual merchandising over technical innovation.

Similarities in Target Audiences

All three brands—Zara, H&M, and Uniqlo—target urban populations, largely aged 18–35, with an appetite for affordable fashion. Their audiences rely on convenience, digital access, and global store availability. These shoppers are socially active, often mobile-first, and drawn to brands that reflect current values, such as sustainability or cultural awareness.

Most are also trend-conscious and influenced by visual platforms like Instagram or Pinterest. Regardless of pricing tier, the emotional pull of looking current and feeling confident remains a shared motivator across all target groups.

Key Differences in Target Audiences

Zara’s shoppers seek exclusivity, fashion leadership, and sophisticated design. H&M customers are more price-sensitive and trend-reactive, often influenced by celebrity partnerships and mass appeal. Uniqlo’s audience is less driven by aesthetics and more by function, durability, and comfort, making it the outlier in a category built on rapid change.

Brand tone plays a role too. Zara maintains a quiet, elegant brand voice; H&M embraces pop culture energy, while Uniqlo speaks in calm, utilitarian tones. These differences shape how each audience connects emotionally with the brand.

Zara Advantages

- Style-Driven Brand Identity

Zara’s sharp design aesthetic and fashion-forward collections consistently appeal to consumers who want runway looks without designer prices. This identity sets it apart from competitors and builds loyalty among style-savvy shoppers. - Rapid Trend Adaptation

Zara’s unique production cycle allows it to bring new designs to market in under three weeks. This agility creates excitement and encourages frequent store visits, giving it a strategic edge in trend relevance. - Minimal Marketing, High Impact

Zara spends little on ads yet maintains high visibility through storefronts, prime locations, and fast stock turnover. This fuels a perception of exclusivity while keeping operational costs low. - Urban-Centric Global Reach

Zara’s focus on fashion capitals and metro areas aligns it perfectly with young, aspirational consumers living in cities where style plays a central social role.

Zara Disadvantages

- Limited Size Inclusivity

Zara has faced criticism for not offering extended sizing, which alienates a growing segment that values inclusivity—something H&M has embraced more successfully. - Sustainability Lag

Despite launching the Join Life collection, Zara is still seen as a latecomer in ethical fashion. Brands like Uniqlo and H&M have taken more proactive steps in transparency and eco-material sourcing. - Inconsistent Customer Service

Zara’s in-store and online support often receive mixed reviews. In contrast, Uniqlo’s reputation for in-store service and product guidance stands out in key Asian and U.S. markets. - High Product Turnover Pressure

The brand’s fast-fashion model, while a strength, can overwhelm certain shoppers who prefer stability or dislike rapid style changes. This limits appeal among those who value classic or long-lasting designs.

Conclusion

Zara’s success lies in its deep understanding of the modern fashion consumer. The Zara target market—young, urban, trend-conscious individuals—drives every aspect of the brand, from rapid product cycles to minimalist branding and global expansion strategies. By using detailed demographic, geographic, behavioral, and psychographic segmentation, Zara effectively tailors experiences that resonate with diverse yet well-defined customer segments.

Its ability to adapt quickly to trends while maintaining a sleek, global identity has kept it ahead in the fast fashion industry. However, as sustainability and inclusivity grow in importance, Zara will need to address these evolving expectations more assertively to maintain its market leadership. Competitors like H&M and Uniqlo are already advancing in these areas, creating pressure for Zara to innovate beyond speed and style.

Ultimately, Zara’s approach to audience targeting—precise, data-informed, and emotionally intelligent—remains a blueprint for modern fashion retail. By continuing to refine its segmentation strategy, Zara is poised to stay relevant in an industry defined by change and consumer connection.