Coinbase Target Market Analysis

Understanding a company’s target market is fundamental for its growth, positioning, and overall success. For businesses operating in rapidly evolving sectors such as cryptocurrency, clearly identifying and understanding their core audience can mean the difference between industry leadership and obscurity. Coinbase, a leading cryptocurrency exchange platform, illustrates this perfectly. By thoroughly analyzing the Coinbase target market, we can better understand how the company has successfully grown into a global fintech powerhouse with millions of users.

Founded in 2012, Coinbase has risen swiftly in the financial technology landscape, becoming a go-to platform for buying, selling, and managing digital currencies. Its ease-of-use, reliability, and regulatory compliance have positioned Coinbase as a trusted entry point for individuals and institutions venturing into cryptocurrency markets for the first time. This article delves deeply into the characteristics, preferences, and segmentation of the Coinbase target market. It will further explore how Coinbase tailors its marketing strategies to reach different segments, including demographic, geographic, behavioral, and psychographic considerations. The goal is to offer actionable insights into how Coinbase effectively connects with and engages its diverse audience segments in the increasingly competitive cryptocurrency exchange industry.

Contents

Who is Coinbase’s Target Audience?

Coinbase primarily targets consumers who seek a secure, accessible, and straightforward entry into cryptocurrency investments. The core audience typically comprises tech-savvy individuals, predominantly aged between 18 to 45, with the majority concentrated within the 25 to 35 age bracket. While historically male-dominated, Coinbase has successfully broadened its appeal, increasingly attracting women and more diverse user groups.

From an income perspective, the Coinbase target market tends toward middle- to high-income earners. These individuals often have discretionary funds available for investing, possess an interest in financial technology, and seek alternative investments outside traditional avenues like stocks or bonds. They are drawn to cryptocurrency due to its promise of high returns, decentralization, and innovation, aligning with their forward-thinking mindset and financial curiosity.

Interest and lifestyle factors among Coinbase’s audience often include technology, entrepreneurship, financial independence, and innovation. These users prioritize convenience, security, and transparency—values Coinbase emphasizes in its product and communications. For instance, Coinbase offers simple educational resources aimed at beginners, as well as more advanced trading options for experienced investors, highlighting its awareness of varied customer experience levels.

Behaviorally, Coinbase’s customers typically exhibit a proactive attitude toward personal finance and investment management. They prefer digital-first interactions, engaging frequently via mobile apps and online platforms. This demographic appreciates Coinbase’s intuitive user interface, comprehensive mobile experience, and robust security measures. Many also exhibit a high degree of brand loyalty, often staying with Coinbase even as they expand their cryptocurrency activities across multiple platforms.

A notable example demonstrating Coinbase’s audience engagement is its Earn Program, where users earn crypto rewards by completing educational modules. This initiative not only attracts new users but also deepens engagement with existing ones, creating a loyal, informed customer base.

Understanding these traits is crucial for Coinbase to continually refine its products, marketing strategies, and overall customer experience, ensuring sustained growth and relevance within the cryptocurrency marketplace.

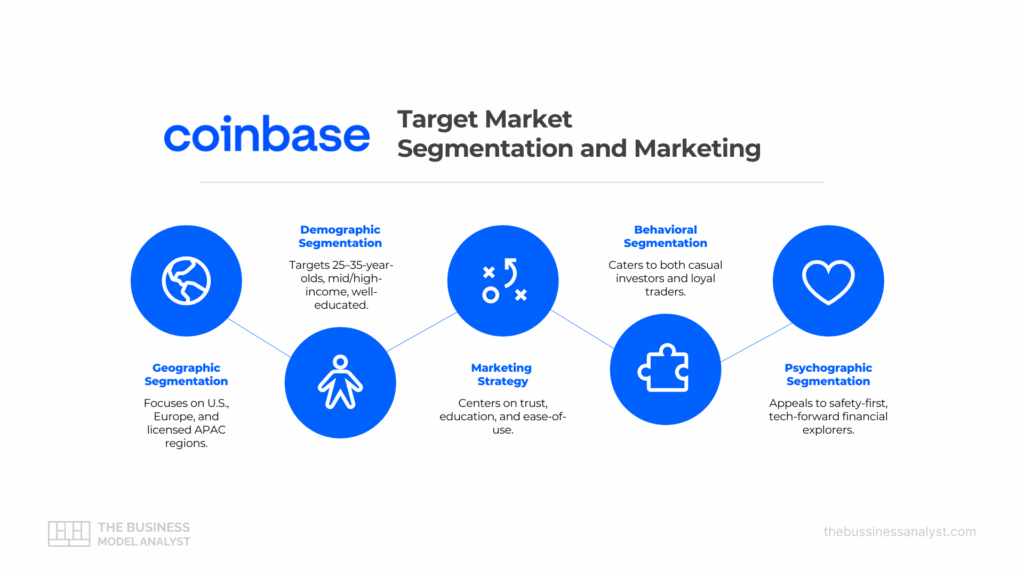

Coinbase Target Market Segmentation and Marketing

Market segmentation involves dividing a broad target audience into smaller, defined groups based on shared characteristics, behaviors, or preferences. Companies like Coinbase apply segmentation to better tailor their marketing efforts, refine their products, and enhance customer experiences. Segmentation helps Coinbase effectively identify opportunities, create targeted messaging, and deepen engagement across diverse user groups.

Coinbase utilizes four primary segmentation types: demographic, geographic, behavioral, and psychographic. Demographic segmentation allows Coinbase to target customers based on age, gender, income level, and education, enabling tailored marketing to various life stages. Geographic segmentation ensures the company’s offerings are relevant and compliant across different regions globally. Behavioral segmentation helps Coinbase understand and predict how customers use its services, informing product improvements and promotional efforts. Finally, psychographic segmentation allows Coinbase to resonate with users’ values, lifestyle choices, and personal identities, reinforcing brand loyalty and emotional connections.

The following sections explore how Coinbase strategically applies each segmentation type, highlighting concrete examples of how the company effectively reaches and retains its diverse and growing user base.

Demographic Segmentation

Demographic segmentation involves categorizing customers based on measurable attributes such as age, gender, income, education, and occupation. Coinbase effectively leverages demographic data to deliver targeted messages and develop tailored products to meet the needs of its diverse user base.

Coinbase’s primary demographic includes adults aged 18 to 45, with a strong concentration in the 25 to 35 age group. These individuals typically have higher technological literacy and are more receptive to digital financial tools. For example, Coinbase’s user interface, which emphasizes simplicity and ease of use, appeals directly to younger, tech-savvy consumers new to cryptocurrency investing.

Gender demographics at Coinbase initially skewed significantly male, reflective of broader cryptocurrency adoption trends. However, Coinbase has strategically expanded its outreach, consciously marketing to women through targeted campaigns, female influencers, and educational content focused on empowering financial independence. Initiatives such as Coinbase’s “Crypto is for Everyone” campaign highlight inclusivity, driving a more balanced demographic composition.

Income level is another key factor in Coinbase’s demographic targeting. The platform primarily attracts users in middle to high-income brackets, many of whom view cryptocurrency investments as supplementary to traditional investment portfolios. Coinbase strategically aligns its messaging to highlight cryptocurrency’s potential for long-term financial growth, appealing directly to these financially savvy investors.

Education-wise, Coinbase attracts users who generally have higher educational attainment, often possessing a bachelor’s degree or higher. To further resonate with this educated demographic, Coinbase has heavily invested in educational resources, including beginner-friendly articles, videos, and tutorials. The Coinbase Learn platform, for instance, serves as a crucial onboarding tool, providing clear and comprehensive guidance that resonates strongly with educated, financially curious users.

Understanding these demographic factors significantly influences Coinbase’s marketing strategies. Campaigns and products are meticulously developed to resonate with the age, gender, income, and education profiles of its users, allowing Coinbase to build and sustain deeper relationships and foster long-term user engagement.

Geographic Segmentation

Geographic segmentation involves categorizing customers based on their physical location, such as country, region, or urban versus rural environments. Coinbase operates globally, but its market penetration is strongest in North America, Europe, and parts of Asia-Pacific. The company strategically tailors its approach to account for regional differences in regulatory compliance, consumer preferences, and financial infrastructure.

In North America, particularly the United States, Coinbase enjoys significant market dominance due to early entry, strong regulatory compliance, and brand recognition. The company has heavily localized its offerings to align with strict U.S. financial regulations, making it one of the most trusted exchanges for American investors. Coinbase’s strategy in the U.S. emphasizes security, reliability, and user-friendly experiences, essential elements for users new to crypto investing.

In Europe, Coinbase has effectively adapted to varied financial landscapes and consumer preferences. For example, the exchange offers payment methods preferred by European users, such as SEPA transfers, and complies fully with GDPR privacy regulations. Additionally, Coinbase has pursued strategic partnerships with European financial institutions, enhancing its credibility and market reach across the continent.

In Asia-Pacific, Coinbase’s geographic strategy varies by country. In countries like Japan, Coinbase secured regulatory licenses and offers localized products, catering to the nation’s strict regulatory framework and conservative investment preferences. Conversely, in Australia, Coinbase targets tech-savvy, high-income users by promoting educational content around cryptocurrency as part of diversified investment portfolios.

Coinbase also differentiates its geographic segmentation strategy in urban versus rural contexts. Urban users, who generally exhibit higher digital literacy and financial engagement, receive messaging emphasizing advanced cryptocurrency trading features and financial education. Meanwhile, rural and suburban users are targeted with more foundational content, emphasizing ease of use, security, and simplified crypto purchasing methods.

By leveraging geographic segmentation, Coinbase can strategically adapt its product offerings, marketing messages, and compliance strategies to meet specific regional demands. This approach enables Coinbase to effectively balance global consistency with regional customization, enhancing user satisfaction and market penetration.

Behavioral Segmentation

Behavioral segmentation classifies customers based on their actions, purchase habits, engagement frequency, and interactions with a company’s products or services. Coinbase leverages behavioral insights extensively to tailor its services, drive customer retention, and maximize user lifetime value.

One critical behavioral factor Coinbase tracks is usage frequency. Regular users—often active traders or frequent investors—are presented with advanced trading tools, real-time analytics, and features such as Coinbase Pro, catering directly to their sophisticated investment behaviors. Coinbase also regularly incentivizes this group through reduced fees and loyalty-based rewards, enhancing retention and increasing user satisfaction.

On the other hand, Coinbase addresses casual users—those who invest sporadically or primarily hold cryptocurrency—with simplified interfaces, educational resources, and gentle encouragement toward deeper engagement. A prime example is Coinbase Earn, an initiative that rewards users with cryptocurrency for completing educational tasks. This program encourages increased interaction with the platform, gently shifting users from casual observers to more engaged investors.

Behavioral segmentation also involves understanding purchase patterns. Coinbase carefully analyzes transaction data, enabling personalized communication and promotional efforts. Users demonstrating a preference for recurring investments receive tailored communications promoting Coinbase’s recurring purchase feature, facilitating effortless, automatic cryptocurrency investments. Such targeted messaging helps Coinbase boost repeat transactions and reinforce habit-forming investment behavior.

Subscription and loyalty behaviors also significantly influence Coinbase’s segmentation strategy. Coinbase One, a subscription service offering zero-fee trades, enhanced support, and account protection, directly targets loyal, frequent users. By analyzing behaviors such as trading frequency and investment volume, Coinbase proactively offers these premium services, driving greater user retention and brand loyalty.

Overall, Coinbase’s behavioral segmentation enables highly personalized marketing, strategic product enhancements, and increased user engagement, significantly contributing to its robust growth and customer satisfaction.

Psychographic Segmentation

Psychographic segmentation explores customers’ values, attitudes, personalities, lifestyles, and beliefs—factors that influence how individuals emotionally connect with a brand. For Coinbase, understanding the psychographic traits of its users is vital to cultivating loyalty and shaping its brand tone.

Coinbase’s target market often values innovation, autonomy, and financial empowerment. Many users are early adopters—individuals who embrace new technology and seek to shape their financial future independently. These users resonate with Coinbase’s positioning as a secure yet forward-thinking gateway to digital assets, appreciating the sense of control and empowerment offered by self-managed investments.

Lifestyle plays a key role in Coinbase’s psychographic segmentation. The platform appeals to those pursuing financial independence, side hustles, or entrepreneurial ventures. For example, Coinbase’s educational content and intuitive interfaces attract gig economy workers and digital nomads seeking flexible, mobile-friendly investment options. The company’s messaging consistently emphasizes simplicity, transparency, and accessibility, aligning closely with the values of self-directed investors.

Beliefs about the broader financial system also influence Coinbase’s audience. Many users are drawn to cryptocurrencies because they desire alternatives to traditional banking, expressing skepticism about centralized financial institutions. Coinbase taps into these beliefs by highlighting security, privacy, and the decentralized nature of crypto in its campaigns—such as the “Crypto is for Everyone” initiative, which frames digital currency as a democratizing force.

Emotional triggers are central to Coinbase’s psychographic targeting. The brand’s marketing often leverages themes of empowerment and belonging, encouraging users to see themselves as part of a revolutionary movement. For instance, campaigns spotlighting individual investor stories foster a sense of community and shared purpose among users.

Coinbase’s ability to understand and speak directly to these psychographic traits allows the company to create deeply resonant messaging, enhance customer loyalty, and differentiate itself in a competitive landscape.

Coinbase Marketing Strategy

Coinbase’s marketing strategy revolves around building trust, lowering barriers to entry, and positioning itself as the most accessible platform for both new and experienced cryptocurrency users. The company employs a blend of digital marketing channels—including social media, online advertising, influencer partnerships, and content marketing—to reach its audience.

The tone of Coinbase’s messaging is consistently professional, transparent, and educational. Campaigns are designed to demystify cryptocurrency, providing clear explanations and practical guidance for beginners, while also highlighting sophisticated tools and features for seasoned investors. Emotional appeal is rooted in themes of empowerment, security, and financial opportunity. Real-world campaigns such as Coinbase Earn and the “Crypto is for Everyone” initiative not only drive brand awareness but also reinforce Coinbase’s position as an inclusive, trusted leader in the industry.

By focusing on education, security, and simplicity, Coinbase has managed to build credibility and establish a broad, engaged user base, effectively meeting the evolving needs of its diverse audience.

How Coinbase Reaches Its Audience

Coinbase uses a comprehensive, multi-channel approach to connect with its diverse audience segments. By leveraging a mix of digital platforms, strategic partnerships, educational initiatives, and personalized experiences, Coinbase maximizes its reach and engagement across different user groups. Here’s how the company ensures its message resonates with every segment of the Coinbase target market.

Digital Content and Education

Coinbase invests heavily in educational content to lower barriers to entry for newcomers. Through the Coinbase Learn portal, blogs, and explainer videos, the company provides step-by-step guides on cryptocurrency basics, security tips, and investing strategies. The Coinbase Earn program is a standout example, rewarding users with crypto for learning about new digital assets. This educational focus builds trust and empowers users to make informed investment decisions, helping beginners gain confidence while keeping experienced users engaged with the latest trends.

Influencer Partnerships and Social Media

Coinbase actively collaborates with financial influencers, content creators, and industry thought leaders on platforms like YouTube, Twitter, and Instagram. These partnerships are designed to amplify Coinbase’s reach among younger, tech-forward audiences who rely on peer recommendations and online communities for financial advice. For example, partnerships with finance YouTubers and crypto Twitter personalities have helped demystify complex topics and promote new features. Social media also enables real-time engagement, allowing Coinbase to respond quickly to news, trends, and customer feedback.

Strategic Partnerships and Sponsorships

Coinbase extends its brand visibility through high-profile sponsorships and partnerships. One notable example is the company’s sponsorship deal with the NBA and WNBA, bringing Coinbase into mainstream conversations and enhancing its credibility with sports fans. Additionally, partnerships with companies like PayPal and Visa have expanded Coinbase’s reach, allowing users to connect traditional financial tools with their crypto wallets. These collaborations create seamless on-ramps for new users and reinforce Coinbase’s reputation as a legitimate, secure platform.

Personalized Product Experiences

Coinbase employs advanced data analytics and user behavior tracking to personalize its communication and product offerings. For instance, users who demonstrate frequent trading activity receive targeted suggestions for advanced features or invitations to Coinbase Pro. Meanwhile, new users receive onboarding emails, security prompts, and tailored content recommendations designed to build trust and ease them into the crypto ecosystem. This personalized approach increases user satisfaction and drives long-term loyalty by ensuring every segment feels understood and supported.

Coinbase’s combination of education, community engagement, strategic partnerships, and personalized experiences enables the company to connect with its audience on multiple levels, driving both acquisition and retention across an ever-growing, global user base.

Comparison to Competitors’ Target Audience

Coinbase’s approach to targeting and engaging its audience stands out in the increasingly crowded cryptocurrency landscape. To better understand the nuances of the Coinbase target market, it’s instructive to compare it with the target audiences of two major competitors: Binance and Robinhood. This comparison reveals the similarities, differences, and strategic advantages that shape brand loyalty and growth.

Coinbase vs Binance Target Audience

Binance, the world’s largest cryptocurrency exchange by trading volume, targets a more global and technically sophisticated audience. While Coinbase emphasizes simplicity, compliance, and accessibility—attracting a broader range of beginners and mainstream users—Binance primarily appeals to active traders, crypto enthusiasts, and those seeking a wider array of digital assets. Binance users often skew younger and are typically more comfortable navigating complex trading features such as futures, options, and DeFi integrations.

Coinbase, meanwhile, has positioned itself as a gateway for first-time investors in North America and Europe, emphasizing security and regulatory trust. In contrast, Binance’s audience is more dispersed, with significant traction in Asia, Africa, and Latin America, where users value low fees and access to new tokens. Binance’s global, multi-lingual platform is designed to meet the needs of users who demand flexibility and advanced trading tools, making its audience more niche and experienced compared to the broader, trust-focused Coinbase target market.

Coinbase vs Robinhood Target Audience

Robinhood, while best known for stock trading, has made a significant push into crypto. Robinhood’s target audience overlaps with Coinbase in age, typically ranging from 18 to 35, but is often composed of younger, first-time investors motivated by convenience, zero-commission trading, and a mobile-first experience. Robinhood’s branding appeals to those interested in democratizing finance and making trading accessible to everyone, regardless of investment experience.

However, Robinhood’s crypto offering is more limited, appealing to users who are curious about digital assets but primarily interested in stocks or ETFs. The platform’s simple, gamified interface attracts users looking for quick, easy access, whereas Coinbase users may graduate to more advanced crypto investing over time, seeking deeper educational resources and a broader asset selection. This distinction positions Robinhood as a “starter” platform, while Coinbase is often seen as a comprehensive, crypto-native solution for ongoing participation.

Similarities in Target Audiences

All three platforms—Coinbase, Binance, and Robinhood—target young, tech-savvy adults who are open to digital investing and eager to explore new financial opportunities. Their users are generally comfortable with mobile apps, value convenience, and seek out platforms that combine simplicity with robust security. Each brand emphasizes accessibility, onboarding content, and trust-building measures as core to their audience engagement strategies.

Key Differences in Target Audiences

The main differences emerge in experience level, geographic reach, and risk tolerance. Coinbase’s audience is more mainstream and risk-averse, prioritizing compliance and education. Binance appeals to global, highly active traders who seek advanced features, low fees, and broad token selection. Robinhood targets newcomers to investing, using a familiar, stock-trading context as a bridge to cryptocurrency. Each brand’s messaging, product development, and customer support reflect these strategic priorities, influencing user loyalty and market share.

Coinbase Advantages

- Regulatory Trust and Security

Coinbase’s strong focus on regulatory compliance and user security gives it a competitive edge in attracting cautious, mainstream investors. This reputation has been critical in forming partnerships and securing institutional clients, which smaller or less-regulated exchanges cannot easily match. - Educational Leadership

Coinbase’s robust educational resources lower entry barriers for beginners and help build confidence among new users. Campaigns like Coinbase Earn have both educated and incentivized millions, driving high engagement and brand loyalty. - User-Friendly Interface

Coinbase’s intuitive platform is designed for accessibility, helping demystify crypto for novices. This ease of use is a significant differentiator, drawing in users who might otherwise be intimidated by more complex exchanges. - Brand Credibility in Major Markets

Coinbase enjoys unmatched brand recognition in North America and Europe, thanks to its early entry and transparent operations. This visibility not only attracts retail users but also opens doors to lucrative partnerships and institutional adoption.

Coinbase Disadvantages

- Higher Fees Than Competitors

Coinbase’s fee structure is typically higher than Binance and other global platforms. This can drive experienced or high-volume traders toward competitors, especially as users become more cost-conscious. - Limited Asset Selection

While Coinbase is constantly adding new cryptocurrencies, its selection still lags behind Binance, which offers hundreds of tokens. Advanced users seeking access to niche coins or DeFi projects may prefer the broader options elsewhere. - Slower Global Expansion

Due to its focus on regulatory compliance, Coinbase has taken a slower, more cautious approach to global expansion compared to Binance. This can limit its presence in emerging markets where crypto adoption is accelerating. - Less Appeal for Advanced Traders

Coinbase’s user-friendly design sometimes comes at the expense of advanced features. Serious traders may prefer platforms like Binance or Kraken, which offer sophisticated charting tools and deeper market integrations.

Conclusion

The analysis of the Coinbase target market highlights why deep audience understanding is so crucial in the fast-moving world of cryptocurrency. By segmenting its audience demographically, geographically, behaviorally, and psychographically, Coinbase has built a platform that appeals to both new and experienced investors who value trust, education, and user-friendliness.

Coinbase’s strengths—regulatory trust, educational leadership, and accessibility—set it apart from competitors like Binance and Robinhood. However, challenges remain, particularly around fee competitiveness, global reach, and features for advanced traders. As the crypto market evolves and new technologies emerge, Coinbase will need to continually adapt its segmentation strategies, products, and marketing to maintain its leadership and address the changing needs of its audience.

Ultimately, Coinbase’s ability to deeply understand and connect with its users—while balancing global ambitions with compliance—has been the foundation of its growth. As market dynamics shift, this audience-centric approach will remain central to Coinbase’s continued success.