WeWork Business Model

The WeWork business model involves taking out long-term leases on properties in prime locations, building physical and virtual offices for entrepreneurs and companies across various sectors and domains, from services to start-ups.

That being said, WeWork is a real estate company offering rent co-working spaces. The WeWork business model has been built precisely on this demand, providing shared workspaces for coworking. Currently, WeWork works on a “space-as-a-service” membership business model and operates in more than 700 locations in 150 cities across 38 countries, making it one of the world’s largest coworking companies.

Contents

A brief history of WeWork

WeWork’s foundation goes back to 2008, with former CEO Adam Neumann and Miguel McKelvey. Neumann had previously served in the Israeli Navy and Military and had come to America to start his own business. In New York City, he met McKelvey, an architect who wanted to establish a company but had no clue how to begin.

Both were living in a vast space building, and they came up with the idea to share the vacant space. For that, they founded GreenDesk, which would provide eco-friendly coworking spaces to small businesses and independent professionals in Brooklyn.

In 2010, GreenDesk was sold, and the pair started developing WeWork, which had its official launch the following year in the SoHo district. The company gained traction very quickly, which allowed a fast expansion. In 2014, WeWork expanded to other cities in the U.S., in 2015, in Europe, in 2016, in China and India, and in 2017, in Latin America.

The growth attracted attention from investors. Until now, WeWork has raised over $1.43 billion in seven rounds of funding, with investments from high-profile companies such as Goldman Sachs, J.P. Morgan, and Harvard Management Company.

WeWork went public in 2020. Nowadays, it is worth $9 billion.

WeWork Mission Statement

The WeWork mission statement is “Empowering tomorrow’s world at work.”

How WeWork makes money

WeWork’s revenue model applies to four types of memberships :

1. All Access

It is the cheapest membership form and is the favorite one for most freelancers and solo workers. The clients are offered many desks in a workspace where they can choose where to work. They can follow their hours and schedules.

2. Dedicated Desks

As the name already suggests, in this plan, the clients have their own assigned desks dedicated to their business, and these desks will always be booked for them as long as the plan is still valid. It is a nice alternative for those who want a more stable option but don’t need a private space.

3. Standard Offices

This option is best for small teams or solo workers who require privacy. The offices can be decorated as the client desires and usually accommodate as many as twenty people.

4. Office Suite

The office suite is suitable for as many as 100 people, so it is indicated for larger businesses that do not need/want to buy their own spaces. Different layout options and the environment can be customized, including reception desks, conference rooms, executive offices, and more.

5. Full-floor Office

This brings the same concept of the Office Suite but maximized into an entire floor. It offers the highest level of exclusivity and privacy with the client’s own branded entry, conference rooms, executive offices, etc., for over 100 workers.

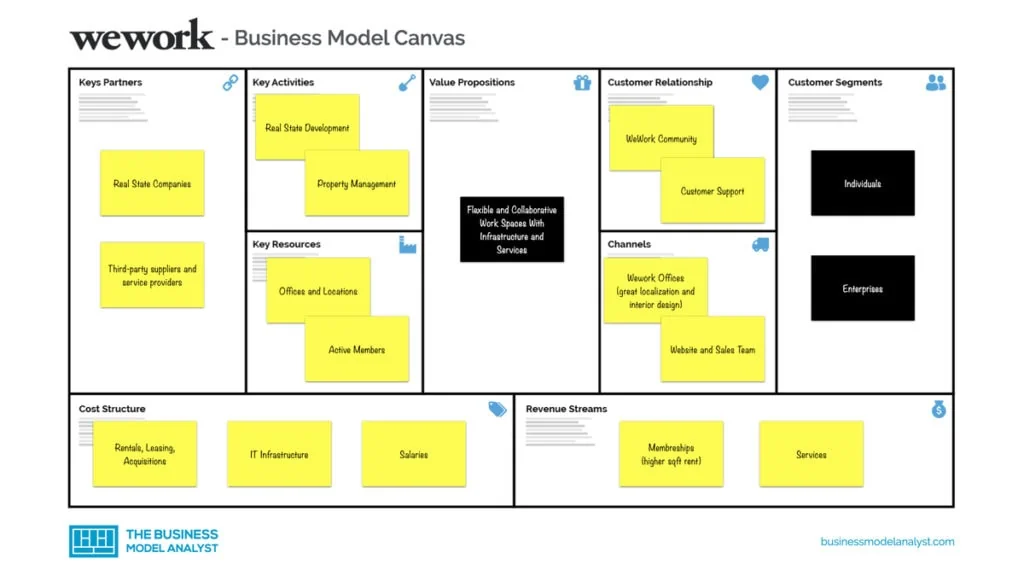

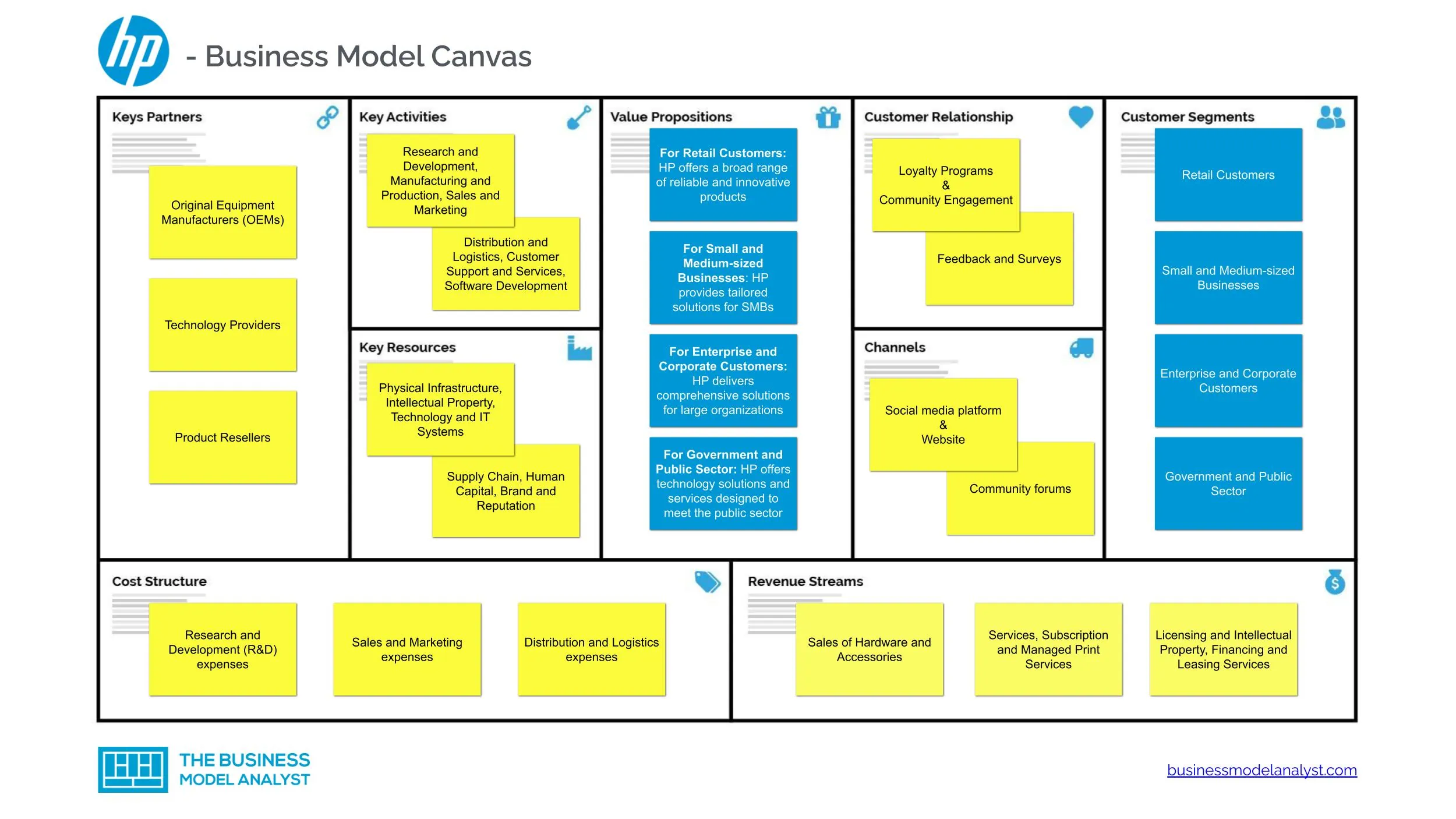

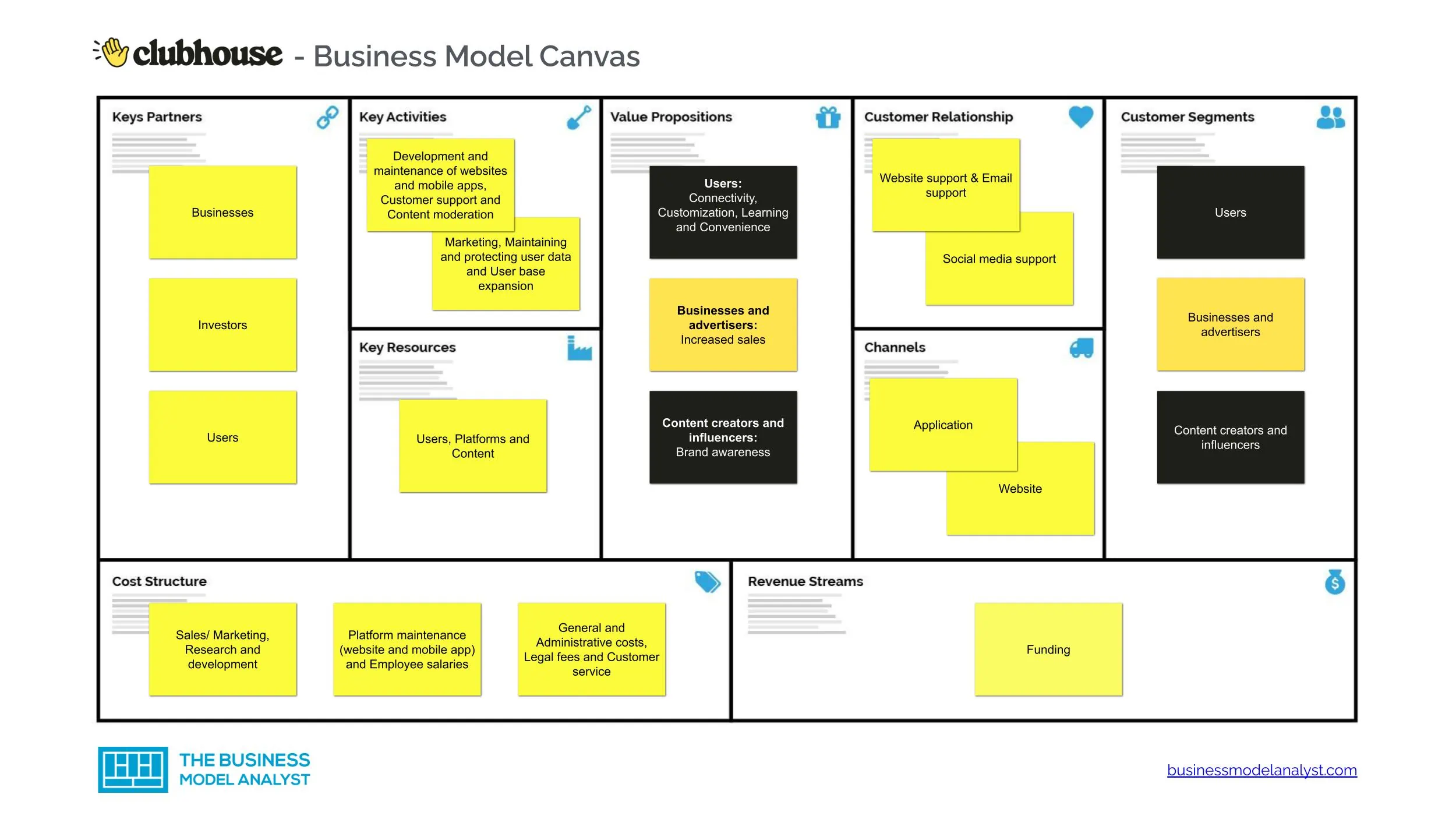

WeWork Business Model Canvas

Let’s take a look at the WeWork Business Model Canvas below:

WeWork Customer Segments

WeWork’s customer segments consist of:

- Individuals: Freelancers, independent professionals, solo entrepreneurs;

- Enterprises: Small, medium, and large-sized businesses and startups.

WeWork Value Propositions

WeWork’s value propositions consist of:

- Flexible pricing model

- Quality facilities

- Amenities & services provision

- International reach

- Community atmosphere

- Event spaces

- Great location

- No upfront costs

WeWork Channels

WeWork’s channels consist of:

- WeWork Offices

- Website and app

- Sales team

- Word of mouth

- Online and offline marketing

- Social media

WeWork Customer Relationships

WeWork’s customer relationships consist of:

- WeWork connected community

- Customer support

- Sales team

- Social media

WeWork Revenue Streams

WeWork’s revenue streams consist of:

- Memberships

- Services

WeWork Key Resources

WeWork’s key resources consist of:

- Human resources

- Offices and locations

- Physical assets

- IT structure

- App and web services

- Partners and service providers

- Active members

WeWork Key Activities

WeWork’s key activities consist of:

- Real-estate development

- Property management

- Consulting services

- Virtual office development

- Software development

- Events management

- Customer support

- Market development

- Marketing and sales

WeWork Key Partners

WeWork’s key partners consist of:

- Investors

- Real-estate companies

- Landlords and property owners

- Brokers and referral network

- Third-party suppliers and service providers

- Alliance companies

WeWork Cost Structure

WeWork’s cost structure consists of:

- Rentals

- Acquisitions

- Leasing

- Salaries

- IT Infrastructure

- Payment fees

- General and administrative

WeWork Competitors

- IWG: A Switzerland-based multinational corporation founded in 1989 as Regus and taken public in 2000. It operates several brands that provide short-term office space to companies;

- Knotel: Founded in 2016, it has recently become a unicorn. It operates in 15 cities across three continents, with plans to eventually double the number of towns it does business in;

- Industrious: Founded in 2013, rather than leasing space and then renting it out to companies, it has been functioning as a management company for its landlord partners, with 90 locations in more than 45 U.S. cities;

- Convene: Founded in 2009, its approach is to operate part of a building as a co-working space through a management agreement or partnership lease and then offer its hospitality services to all tenants in the building;

- CommonGrounds: A California-based startup that uses a reusable version of drywall to install a movable wall system intended to prepare new spaces for tenants quickly. Though the company currently has just 8 locations, it has plans to expand to 50 locations;

- Studio by Tishman Speyer: The real estate giant Tishman Speyer aims to combine the flexibility of the co-working’s short-term leases with high-end building services;

- The Wing: A co-working space only for women that also aims to act as a professional network and community, with women-targeted amenities, like mother’s rooms, and events featuring high-profile women like Shonda Rhimes;

- Impact Hub: A Vienna-based global network of community and co-working spaces targeted at businesses and nonprofits that aim to create social good, it relies on over 100 spaces in more than 50 countries;

- Servcorp: An international, Australia-based company that leases office space in some of the world’s most iconic buildings by enforcing a dress code. It has more than 160 co-working sites in over 20 countries.

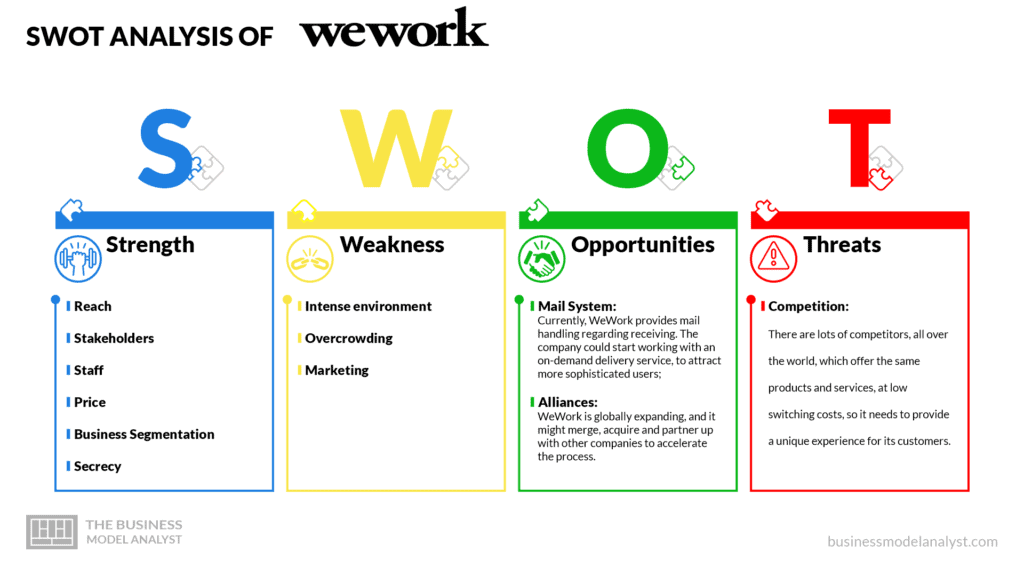

WeWork SWOT Analysis

Below, there is a detailed swot analysis of WeWork:

WeWork Strengths

- Reach: WeWork has workspaces in the major developed countries in the world, like the U.S., Canada, Germany, and the UK, and as it offers offices in over 38 countries, that makes the brand considered international;

- Stakeholders: WeWork valuation has, in a good part, been built over the names that fund the company, such as Softbank, J.P. Morgan, and Benchmark;

- Staff: Currently, more than 15,000 people are working for the company, and dedicated human resources are significant assets for an organization;

- Price: Compared to its competition, WeWork offers very economical workspaces with enjoyable amenities and valuable services;

- Business Segmentation: WeCompany, the parent organization of WeWork, has many subsidiaries, such as WeLive, WeRise, and WeMRKT, besides WeWork. These multiple segments enable the brand to reach more people, thus widening the business;

- Secrecy: WeWork does not share any information about its tenants.

WeWork Weaknesses

- Intense environment: Some people avoid WeWork offices because of the fierce work environment inside, which, for some of them, can even be classified as stressful. Besides, for the newcomers, it is sometimes difficult to adjust because the people who are already there are pretty familiar with everything and everyone, while the new ones may feel like they are outsiders;

- Overcrowding: The collective space at WeWork can be overcrowded sometimes, and there are plenty of people who enjoy working in a quiet place with just a few others to avoid a lack of concentration;

- Marketing: As the advertisement agency of WeWork is its in-house agency under WeCompany’s umbrella, it is sometimes inefficient because it cannot focus on each subsidiary separately.

WeWork Opportunities

- Mail System: Currently, WeWork provides mail handling regarding receiving. The company could start working with an on-demand delivery service to attract more sophisticated users;

- Alliances: WeWork is expanding globally, and it might merge, acquire, and partner with other companies to accelerate the process.

WeWork Threats

- Competition: Many competitors worldwide offer the same products and services at low switching costs, so it needs to provide a unique experience for its customers.

Conclusion

WeWork caters to individual professionals and enterprise customers, offering flexibility compared to traditional office rentals. The coworking industry has been redefined by providing access to fully furnished spaces without the burden of fixed costs such as long-term leases or property depreciation.

With its focus on flexible office solutions and the coworking business, WeWork guides businesses exploring shared workspace options by setting a new benchmark for an office space leasing company. This case highlights how innovation in the industry can transform the future of work, offering companies the chance to rent office space cheaply while focusing on growth and collaboration.

WeWork’s innovative approach to workspace solutions has attracted the backing of some of the world’s most famous and successful companies, such as Microsoft, IBM, Amazon, Airbnb, and Samsung. This underscores the industry’s potential and WeWork’s role in shaping the future of work. With the company currently looking to expand into Eastern countries, it’s clear that the demand for flexible, collaborative workspaces is only growing.

Thanks for you posting which gives good understanding for WeWork~